Hancock Advisors Report

The purpose of this report is to provide information on emerging technology providers that offer digital services and facilitate data analytics and transactions in the healthcare space, with a focus on technologies that contribute to the growing trend of bringing care to patients at home. Since these technologies are broad and hard to segment, the overview will focus on healthcare information technology (HCIT). HCIT may include electronic health records (EHR), electronic prescribing (e-prescribing), and technologies that connect physicians with patients at home (telehealth). As a general rule, all the sub-industries are highly fragmented, and companies usually offer services across multiple sub-industries, thus complicating the effort to categorize the leaders in each sub-industry. This report gives an overview of the healthcare sector, the HCIT industry, the domestic EHR market, telehealth, and RCM, then introduce the major and emerging companies that may attract the readers’ interest, and lastly offer our perspective on the pandemic’s impact on the industry.

Introduction

According to the CMS fact sheet, domestic healthcare was a $3.6 trillion market in 2018 by annual expenditure, making it the largest private-sector industry in the United States. To put this scale in context, $3.6T of annual expenditure puts healthcare at over two times the size of the global payments industry ($1.4T in 2018 according to BCG) and approximately 6.0x the domestic defense industry ($640B in 2018 according to the U.S. Department of Defense). Healthcare expenditures continue to grow at a healthy pace – costs are projected to accelerate by over a full point in the coming decade, shifting from a 4.3% CAGR in 2007-2019 to a 5.5% CAGR through 2027, driven by expanded coverage, aging population demographics and cost inflation within the system, and accelerated by the pandemic in 2020.

Nevertheless, IT spending makes up a proportionately small amount of healthcare expenditure, with a significant investment opportunity if healthcare IT penetration progresses more in line with other industries. According to Gartner, healthcare providers in the US spent $47B on IT services in 2019, or just over 1.2% penetration of the $3.8T in 2019 domestic healthcare expenditure. IT penetration across other industries falls into the range of alow of 1% (energy/natural resources) and a high of 8% (software/internet). Assuming healthcare solely reaches the cross-industry IT penetration average of 3.3% implies an incremental HCIT revenue opportunity of nearly $80B, or approximately 1.7x today’s HCIT market.

Moreover, research cited by the National Academy of Medicine estimates that 30% of U.S. healthcare spending is unnecessary or “wasted.” This implies more than $1T of unnecessary spending in the

US healthcare system in 2019. Failure to adhere to best care practices, lack of care coordination, inaccurate claims submissions, and overtreatment are the main drivers of the wasted resources. Fraud and abuse only account for a small portion of total waste and inefficiencies.

Even so, our house view is that the “wasted” healthcare spending is actually an opportunity for the healthcare IT vendors that focus on streamlining processes, improving efficiencies, and outsourcing systematic complexity, especially start-ups that focus on certain kinds of problems and niche areas. For example, Sandata Technologies is a leading U.S. provider of home care solutions that enable government agencies, managed care organizations, and home care providers to manage and optimize the delivery of

services. In the last forty years, the company created the Home Care Network that connects the homecare industry of payers, providers, and participants with existing acute, ambulatory, and managed care networks. Integrated networks like this provide ease to patients at home and reduce redundancies in the process, thus reducing the “waste” in the system.

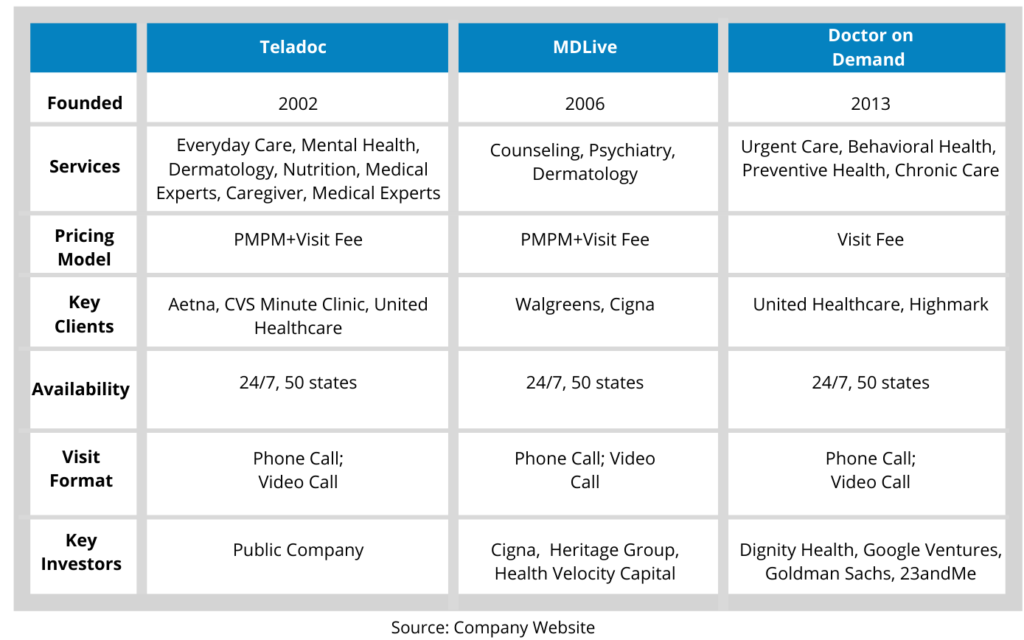

To give a better overview of the HCIT industry, it is important to highlight customer retention and pricing. Retention is extremely high for the HCIT platform space, with renewal rates running at over 95% on both a revenue and client basis. The stickiness is due to the embedded nature and scale of core HCIT systems, making platform replacement costly and time-consuming. The industry also encompasses different pricing models for various service providers. Provider-facing names tend to have a contract sales model with contracts averaging 5 years and up to 10 years, while EHR platforms are often sold under a perpetual license model, where the customer purchased the software usage license up-front for a sizable fee. In recent years, the industry has been shifting to a subscription-based licensing model, where the customer pays a monthly software usage fee instead of the upfront license and maintenance fees. Other pricing models include performance fees and per member per month (PMPM) model. The former is common among pure-play revenue cycle management companies since they generate revenue primarily through a percentage fee on cash collections volume. The PMPM model is typical for member-based platforms, such as Teledoc, and is often used in combination with other pricing dynamics such as flat install fees and contracted revenue minimums.

As we mentioned earlier, the industry’s fragmented nature makes it difficult to categorize companies in the space. However, we can find common activities and functions the companies engage in, namely EHR, Telehealth, and RCM. In the following sections, we will give a snapshot of each space, including definitions and trends to enhance the reader’s understanding.

Electronic Health Record (EHR) Market

Electronic health records, or EHRs, are digital versions of a patient’s healthcare charts/records. A key feature of an EHR is that it can be created, edited, and consulted by authorized providers across multiple healthcare organizations.

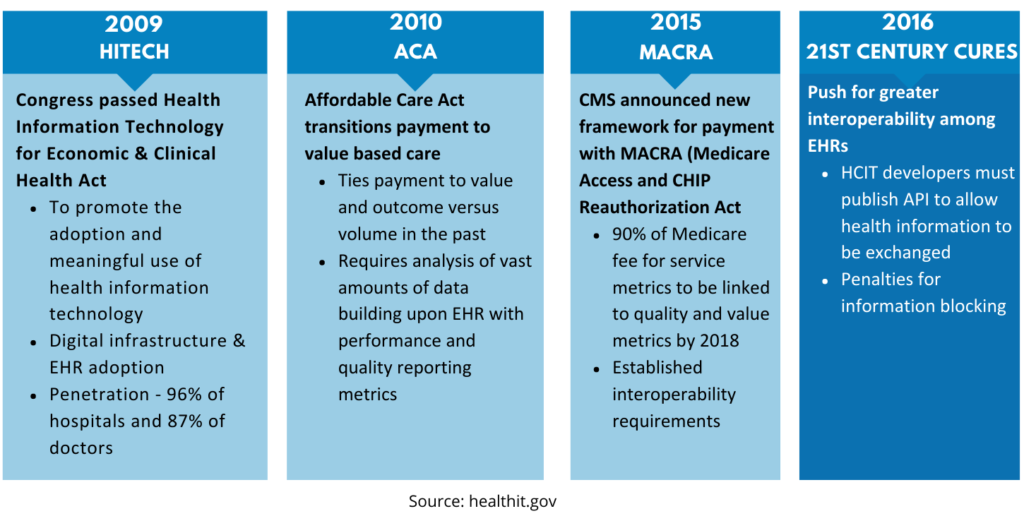

Some of the largest public players within HCIT, such as Cerner and Allscripts, originated as EHR providers, with their scale gains driven by government incentive payments. The HITECH Act (Health Information Technology for Economic and Clinical Health), signed in 2009, outlined the adoption of EHR systems through meaningful use, meaning qualified users will receive reimbursement payments of up to $64k for physicians and $2M for hospitals. According to ONC, the Meaningful Use program brought in rapid and near-universal adoption of EHRs, with hospitals moving from 9% adoption in 2008 to 96% using a certified EHR in 2017 and office-based physicians moving from 42% to 87% during the same period.

Since 2016 marked the final year for the Meaning Use program incentives and hospitals and physician offices have universally adopted EHR, our house view is that EHR companies won’t see significant revenue growth in the following years. However, opportunities remain for M&A and market consolidation since medium-sized companies account for over half of the market share.

Epic

One of the fastest-growing EHR system providers is Epic Systems Corporation. Founded in 1979 and based in Wisconsin, Epic develops software for clinics, specialties, ancillaries, telehealth, revenue cycle, managed care, population health, community connections, and interoperability. One of their key products is MyChart, a health information portal for patients that allow users to message their doctors, attend e-visits, complete questionnaires, schedule appointments, and more. The company offers electronic health records systems and operates Epic Community, a healthcare organization group to improve patient care, innovate healthcare delivery, and achieve financial health. The company employed about 10,000 people globally and had roughly one billion in revenues in 2019. Its latest acquisition was in 2016, and it bought Data Center in Rochester from Mayo Clinic for $46 million.

Allscripts

Allscripts was founded in 1986, it operates as an EHR and clinical solutions provider with broad-based end market exposure, ranging from ambulatory (14% ambulatory EHR market share) to inpatient (8% hospital EHR market share) to international and specialty end markets. Allscripts’ solution suite includes EHR (including Sunrise, TouchWorks, and Paragon), financial management, population health management (CareInMotion), precision medicine/consumer solutions (2bPrecise), and services such as hosting, consulting, optimization and managed IT. Allscripts has historically complemented its organic growth with acquisitions, completing 7 acquisitions over the past 4 years.

Most recently, in January 2018, Allscripts announced the acquisition of Practice Fusion for $100M. Practice Fusion offers an affordable certified cloud-based EHR for traditionally hard-to-reach small, independent physician practices. It was founded in 2005 and supported 30,000 ambulatory practices and 5 million patient visits a month. In 2017 and 2016, Allscripts also acquired McKesson’s Enterprise Information Solutions business for $185M and Netsmart, a behavioral health technology business, for $70 million.

Telehealth Market

In general, telehealth uses telecommunications technology (voice calls, two-way video, email, electronic communications, etc.) to deliver clinical healthcare services remotely. The Center for Connected Health Policy (CCHP) defined telehealth in four categories: live video, store-and-forward care, mHealth, and remote patient monitoring. Just as the name suggested, the live video involves a real-time two-way audiovisual interaction between a patient and a provider to provide consultative, diagnostic, and treatment services. Live video is the most recognized way of telehealth. Though its use has been downplayed in the past due to Medicare payment restrictions, the pandemic this year definitely give it a boost, and the usage numbers skyrocketed; not only did Medicare pay the same rate for video services, physicians licensed in one state are also allowed to see a patient in a different state, which is unthinkable pre-pandemic. According to McKinsey & Company, physicians saw between 50 and 175 times more patients via live video than they did before the pandemic, and our view is that the trend will continue after the pandemic since the quality of services has been tested during this period.

Store-and-Forward Care entails the transmission of pre-recorded health information (i.e., photos, x-rays, and text) to a provider through a secure electronic message, such as an app or an email. mHealth, or mobile health, is defined as healthcare practice and education supported through a mobile device, such as targeted text messages to promote healthy habits, wearables, and disease outbreak warnings.

Remote Patient Monitoring (RPM) means using technology to enable patient monitoring outside of a clinical setting. RPM programs involve collecting medical and health data that is then transmitted to an external monitoring center, such as a primary care setting, hospital, or nursing facility.

Based on the above definitions, technologies to support telehealth are proliferating, and many include wearable devices, smartphones, and instrumented (smart) homes. Smart homes can be equipped with environmental and personal sensors interconnected using the Internet of Things (“things” embedded with sensors, software, and other technologies that connect and exchange data with other devices and systems over the Internet). These devices can monitor patient health and send messages to responsible clinicians when emergencies are detected. These devices’ cost is falling, and an almost unlimited amount of data can now be stored and analyzed. For the scope of this report, though, we will only introduce three telehealth providers. See chart below.

Revenue Cycle Management

Revenue cycle management (RCM) is the term used to describe the revenue collection/monetization process at a provider office. Unlike other industries, RCM solutions are necessary for healthcare since providers often do not know how much they will be paid when treating a patient. Providers use revenue cycle management systems for several reasons, including reducing cost in their billing processes, minimizing insurance claims denials, speeding up benefits verification, and automating processes, such as payments record keeping.

Due to the complexity and sensitive nature of billing and collections, 85% of hospitals manage their own revenue cycle solutions, including in-house staff and multiple software from vendors that service different stages of the revenue cycle. However, vendor fragmentation across the patient/fund flows, and a low level of digitalization in the payments process brought about 10% of basic claims rejected on the first pass and hospital bad debt levels ranging in the low double digits a percentage of revenue. To complicate the issue, the adoption of high deductible plans means patients are increasingly responsible for paying their medical bills. Unless providers evolve their payments systems to be more in line with the broader consumer experience, we believe this trend will create incremental pressure on the collections process since the bad debt rate is much higher for individual payers (Medical Group Management Association data shows that providers typically collect less than 50% of post-insurance balances from individuals compared to over 90% collections rate from payers).

To mitigate this issue, RCM outsourcing to integrated vendors that can manage the entire billing and collection process will be an inevitable choice for healthcare providers.

Emerging Companies

As we mentioned earlier, great opportunities remain for start-ups and small-and-medium-sized companies that focus on certain kinds of problems and niche areas, especially companies that optimize the value chain and bridge the gap (either communications or payments) between providers and patients at home, such as payer services and data digitalization and analytics companies. Here we present a few companies with excellent management teams and solid revenue growth that will make great M&A targets for readers’ interest.

Healpros

HealPros was launched in 2011 to support health plans in closing the diabetic retinal exam gap. iComply Solution, the company’s leading product, is the industry’s first fully mobile solution bringing state-of-the-art diabetic retinal eye exams to members’ homes, and its services have expanded to include additional preventative screenings for A1c, microalbumin, and colorectal cancer. By utilizing HealPros, major U.S. health plans (and their partners) close essential care gaps across various disease states, thereby increasing quality measures (HEDIS/STARS) and reducing costs. HealPros has established its position as a market leader, with active contracts at 80% of leading US Health Plans

Alora Software

Founded in 2005, Alora is an Atlanta-based healthcare software company that focuses on digitizing the workflow (EHR and paperless documentation) and revenue cycle management for small healthcare providers. The Alora software family includes the home health software and the home care software. The former is an enterprise EHR system that has been designed to meet all aspects of a home health care agency operation (skilled and non-skilled), including back-office administration and clinical documentation, while the latter is designed for home care agencies dealing with non-skilled services. Both products bill all payers, including Medicare, Medicaid/Waiver, Managed Care, Commercial Insurance, VA, and Private Pay. Its revenue has seen an increase of 40% year on year, and the pandemic has accelerated its growth.

Forcura

Founded in 2012 and based in Jacksonville, Florida, Forcura is a technology platform that transforms how healthcare organizations manage information by digitizing workflow and care coordination, which turns into better patient care, improved cash flow, and reduced administrative expenses for providers. Forcura systems guarantee paperless document workflow and secure communication from any device – all while patients are interfacing seamlessly with providers’ existing systems. In July 2020, Forcura secured significant growth investment from Accel-KKR, a leading Silicon Valley-based technology-focused private equity firm.

Impact of the Pandemic on HCIT

To put it simply, the pandemic has changed channels that patients choose to access providers in an unprecedented way. As we mentioned earlier, physicians and other health professionals are now seeing 50 to 175 times the number of patients via live video than they did before the pandemic. According to McKinsey & Company, 46% of patients are now using telehealth to replace canceled in-person visits, up from the just 11% of patients who used telehealth in 2019. The COVID-19 pandemic propelled patients and physicians to adopt telehealth quickly, and in the future, the virtual visits could account for $250 billion, or about 20%, of what Medicare, Medicaid, and commercial insurers spend on outpatient, office, and home health visits. In essence, the pandemic changed people’s perception of the quality of services offered remotely and temporarily altered policy restrictions (CMS allows more than 80 new services to be conducted via telehealth during this health emergency), which may turn into long-term policy change. The McKinsey & Company surveys estimate that 57% of providers view telehealth more favorably than before COVID-19, and 64% report that they are more comfortable using it. Therefore, it is reasonable to project that telehealth will be more embedded in the care delivery system after the pandemic, and the spotlight will be on innovative companies that offer services in the value chain.

As we defined earlier, telehealth may include live video, mobile health, and technologies that enable wearables to track data. Under this definition, we see two trends that will build on the momentum accelerated by the pandemic. One is virtual home health services that leverage virtual visits, remote monitoring, and digital patient engagement tools to enable some of these services to be delivered remotely, such as a portion of an evaluation, patient and caregiver education, and physical therapy. The other is tech-enabled home medication administration that allows patients to shift receiving infusible and injectable drugs from the clinic to the home. This shift can happen by leveraging remote monitoring

to help manage patients and monitor symptoms, providing self-service tools for patient education, and providing telehealth oversight of staff, coupled with home delivery of the therapeutics (similar to the services provided by Healpros). The continuation of both trends will need the participation of all stakeholders in the value chain, namely EHR vendors for patient health data, RCM vendors for payment validation and telehealth for technologies and platforms that enable remote communication, monitoring and analytics and investments from both the public and private sectors to make the transactions seamless.

For example, despite the loosened guidelines and increased willingness for adoption, some providers have struggled with network capacities and broadband access when connecting for virtual visits. In San Diego, Verizon, on May 28, launched a new 5G wireless network, which offers download speeds 10 times faster than a standard network in certain parts of the city to help healthcare providers conduct telehealth visits. The Federal Communications Commission on June 30 announced it is increasing funding for its rural healthcare program to $802.7 million this year as rural providers’ applications for high-speed broadband during the pandemic have exceeded the program’s $604.7 million funding cap.

The pandemic has also spurred innovation in remote monitoring platforms at hospitals and health systems across the country. To continue taking care of patients who no longer require hospitalization, University of California San Diego engineers built a remote monitoring program that automatically transmits data from patients’ wearable devices and uploads it to a dashboard that providers can monitor and use to intervene when necessary. Chicago-based CommonSpirit Health expanded a similar program, which supports at-home patients through biometric monitoring via a mobile app, voice platform, or tablet with devices that track and transmit patients’ vitals and symptoms in real-time. Kristin Myers, executive vice president, CIO, and dean of IT at New York City-based Mount Sinai Health System, said in an interview recently that she expects to see academic medical centers continue investing in remote monitoring, health sensors, and wearables over the next five years as well as continued disruption by big tech companies in the health IT landscape and discussions around patient privacy and data protection.

Conclusion

Based on the above information, we see great opportunities in the following areas, EHR data consolidation and analytics, RCM outsourcing, and devices and wearables that track patient health. Though EHR adoption has been universal, vendors are fragmented, and patients’ historical information often can’t transfer to other providers automatically. Next-level business intelligence and data analytics will require an extensive database that tracks health information and generate predictions for decision-making. RCM outsourcing, as we talked about earlier, health providers usually manage their billings and collections in-house through multiple vendors, which often cause disruptions in the workflow and higher denial rates from payers. Smooth RCM is extremely important for patients to receive care at home since emerging trends often receive more scrutiny from payers, and delayed or even denied payments would

dampen patients’ enthusiasm and willingness to proceed. Lastly, devices and wearables that track patient health are constantly in motion. In April, Stanford Medicine teamed up with Scripps Research and Fitbit on a study that aims to detect early signs of viral infections such as COVID-19 through data collected from wearable devices. Everyone who carries a smartphone can do more things with app design or even phone design to turn it into a health communications device.

In conclusion, we see significant opportunities in the HCIT space during and after the pandemic, especially telehealth that facilitates patients receive care at home, not limited to live video chatting and wearables. It is a revolutionary concept made possible by recent technology developments and spurred on by the pandemic, and future developments will have interactions with big data, artificial intelligence, and even 3-D printing. Given the global aging demographics and increased interest in healthy and happy lives, we believe companies in this space are worth investors’ attention and exploration.

References

- CMS (2020, Dec.16). National Health Expenditure Data. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

- Gartner (2020, Dec.16). Understand Healthcare’s Emerging Trends. Retrieved from https://www.gartner.com/en/innovation-strategy/trends/emerging-trends-barometer-healthcare

- Boston Consulting Group (2020, Dec. 16). Global Payments 2019: Tapping into Pockets of Growth. Retrieved from https://image-src.bcg.com/Images/BCG-Global-Payments-2019-Tapping-into-Pockets-of-Growth-September-2019-rev_tcm9-231986.pdf

- U.S. Department of Defense (2020, Dec.16). DoD Releases Fiscal Year 2018 Budget Proposal. Retrieved from https://www.defense.gov/Newsroom/Releases/Release/Article/1190216/dod-releases-fiscal-year-2018-budgetproposal/#:~:text=Today%20President%20Donald%20J.,Contingency%20Operations%20(OCO)%20budget

- Devenir (2020, Dec. 16). Health Savings Accounts Continue Strong Growth. Retrieved from https://www.devenir.com/health-savings-accounts-continue-strong-growth-has assets-reach-a-record-65-9-billion/

- Center for Connected Health Policy (2020, Dec. 16). About Telehealth. Retrieved from cchpca.org/about/about-telehealth

- The Office of the National Coordinator for Health Information Technology (ONC) (2020, Dec. 16) Healthcare IT Definition. Retrieved from https://www.healthit.gov/topic/about-onc

- The Office of the National Coordinator for Health Information Technology (ONC) (2020, Dec. 16) EHR Adoption. Retrieved from https://dashboard.healthit.gov/quickstats/quickstats.php

- The Office of the National Coordinator for Health Information Technology (ONC) (2020, Dec. 16) Healthcare IT Legislation. Retrieved from https://www.healthit.gov/topic/laws-regulation-and-policy/health-it-legislation

- Medical Group Management Association (2020, Dec. 16) Collecting the Patient’s Responsibility for Care. Retrieved from https://www.mgma.com/data/data-stories/collecting-the-patient-s-responsibility-for-care

- Wikipedia (2020, Dec. 16). Internet of Things. Retrieved from https://en.wikipedia.org/wiki/Internet_of_things

- NPR (2020, Dec. 16) Healthcare Waste. Retrieved from https://www.npr.org/sections/health-shots/2018/02/01/582216198/unnecessary-medical-care-more-common-than-you-might-imagine#:~:text=The%20waste%20is%20widespread%20%E2%80%93%20estimated,each%20year%20on%20health%20care

- CMS (2020, Dec. 16) Medicare Telemedicine Health Care Provider Fact Sheet. Retrieved from https://www.cms.gov/newsroom/fact-sheets/medicare-telemedicine-health-care-provider-fact-sheet

- McKinsey & Company (2020, Dec. 16) Telehealth: A quarter-trillion-dollar post-COVID-19 reality? Retrieved from https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

Click here to download the PDF version of Post-Covid Era: Technologies That Bring Care Home.