Introduction:

Demand for medical aesthetic and cosmetic services has exploded in recent years. Owners and operators of medical spas are frequently contacted by multiple groups looking to partner with or buy their practices. Private equity partnerships can be attractive to owners as a means to expand resources to grow their practices while taking some chips off the table in exchange for lumpsum payments. However, it is important for med spa owners to carefully consider the pros and cons of M&A before making decisions. They should carefully evaluate potential buyers and make sure that they are good fits for their operations, while also ensuring that they are getting fair prices for their businesses. The medical spa industry is currently experiencing a wave of consolidation as private equity firms acquire and grow platforms that are well-positioned to capitalize on the growing demand for aesthetic treatments.

Services:

Medical spas offer a wide range of services that combine medical procedures with spa therapies. These services typically include:

- Injectables: Botox, dermal fillers, and other facial rejuvenation treatments.

- Laser treatments: Laser hair removal, skin resurfacing, tattoo removal, and photofacials.

- Body contouring: Non-surgical fat reduction, cellulite reduction, and skin tightening.

- Skin care: Chemical peels, microdermabrasion, and personalized skincare regimens.

- Wellness treatments: IV therapy, hormone replacement therapy, and nutritional counseling.

- Relaxation therapies: Massages, facials, and hydrotherapy.

Certain medical spas may provide other specialized offerings, such as allergy testing and treatments, hormone replace therapy, IV nutrient therapy, and more. It’s important to note that the availability of these services may vary from one spa to another.

Recent Developments of the “Medical Spa” Industry

Source: American Medspa Association: 2022 Medical Spa State of the Industry Report

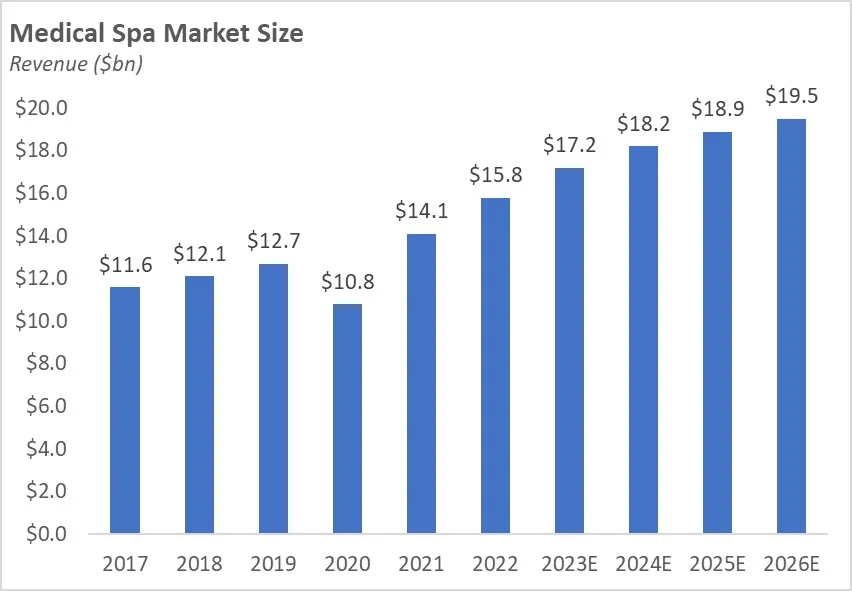

The medical spa industry has grown rapidly in recent years, from less than $2.5 billion in 2010 to an estimated $16.4 billion in 2022. This growth is expected to continue at a compound annual growth rate (CAGR) of 14.97% from 2023 to 2030.

There are several factors that have contributed to the growth of the medical spa industry. These include:

- Advancements in technology: New technologies have made medical spa treatments more efficient and effective. For example, lasers can now be used to remove unwanted hair more precisely and with less downtime than traditional methods.

- Increased demand from women: Women of all ages are increasingly interested in medical spa treatments, but the demand is particularly strong among women in their 20s and 30s.

- Increased use of social media and destigmatization of aesthetic procedures: In the past, aesthetic procedures were often seen as taboo, but this is no longer the case. Thanks to the efforts of celebrities and social media influencers, aesthetic procedures are now seen as a normal part of self-care.

- Increased demand from men: Men are also increasingly interested in medical spa treatments. According to McKinsey, demand from men is expected to double from 2021 to 2026.

- Increased emphasis on self-care and wellness: People are increasingly aware of the importance of self-care and wellness. Medical spa treatments are seen as a way to improve one’s appearance and overall health and well-being.

Why Investors are Interested in the Medical Spa Space:

The explosive growth of the medical aesthetics industry has caught the eye of private equity, family office and corporate investors – leading to an ongoing wave of consolidation in the space. Several factors make the medical aesthetic industry attractive for private equity investment, including:

- High growth potential: the industry is expected to grow at a compound rate of 14.97% from 2023 to 2030.

- Recurring revenue streams: On average, 65% of med spa patients are repeat patients. Patients are typically brand loyal and will come in multiple times per year, spending an average of $536 per visit.

- Highly fragmented market: Investors are motivated to acquire and consolidate med spas to achieve benefits of scale. Approximately 90% of spas are independently owned and 81% operate out of only one location.

- Cash only customer base: Patients typically pay for treatments in cash, which means that there is no need to deal with insurance companies. This can simplify the billing process and improve cash flow.

- High-profit margins: medical spas typically operate at high-profit margins of 15 – 25%.

The medical aesthetics M&A market is expected to remain competitive in the future. In addition to acquisitive growth strategies, firms have also rapidly pursued de novo expansion to meet the increasing demand for cosmetic services. According to the American Med Spa Association, 17% of all medical spa locations were newly opened in 2021.

M&A Activity

For years, private equity firms have been engaging in the consolidation of various healthcare services firms, including dental, orthodontic, orthopedic, physical therapy, veterinary, and other practices. Leading private equity firms such as KKR, L Catterton and Potomac Equity Partners have already begun to invest in the medical aesthetic space. Other groups including Advanced Aesthetic Partners, Medspa Partners Inc., and Princeton Medspa Partners are solely focused on the medical aesthetic industry and continue to lead consolidation in the space. Additionally, our partners have held conversations with several groups that have not made investments in the space but are looking to do so in the near future.

The medical spa and aesthetics M&A market is one of the most active sectors within the healthcare industry. Some of the recent notable transactions are listed below:

Valuations

Like most businesses, medical spas are valued based on a multiple of their EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization). The formula for calculating EBITDA is Net income + interest expense + taxes + depreciation + amortization. EBITDA multiples for medical spas typically range from 5 on the low end, up to high 8-9 for single-location practices. Practices with multiple locations command higher valuations and typically range anywhere from 7-13x. Other factors that impact valuation are location quality as well as historical and future growth rates of the practice(s).

Importance of Running a Process

In the dynamic landscape of medical spa M&A, it is important to engage an advisor with industry knowledge and relationships with leading acquirers. Like the process of selling a house, a process with multiple bidders can optimize the outcome of a sell-side transaction. Approaching multiple buyers helps ensure that sellers can identify the most suitable fit, aligning with their specific needs, objectives, and priorities. An advisor plays a pivotal role in maintaining confidentiality throughout the process, while also freeing up valuable time for sellers to focus on their core business operations.

Hancock Advisors partners with you to help achieve your business objectives, whether valuing and selling your business, raising capital to fund growth initiatives, or performing an acquisition search. We work directly with business owners and investors, specializing in M&A and general corporate finance advice. Our team has 100 years of transaction and industry experience, which we use to help businesses evaluate, navigate, and successfully execute a full range of strategic alternatives. Our partners have extensive experience with medical practice M&A, and we are currently in the market on both the buyside and the sell-side engagements in the medical aesthetics industry. We work in partnership with Hancock Askew, a Georgia and Florida-based regional accounting firm, to support us with expert advice.