HANCOCK ADVISORS REPORT

Industry Trends

In March of 2020, COVID-19 created a level of uncertainty that slowed or halted many medical practice operations, causing more than 6% of US primary care physician offices to close temporarily. However, byQ2/Q3 of 2020, many practices were able to reopen. Though 87% of practices reported they had recovered patient volumes by June 2020, dentists and dermatologists continued to lack traffic. Practices suffering losses were offered financial aid through the US Government’s CARES Act, designating funding for the Department of Health and Human Services (HHS) Public Health and Social Services Emergency Fund. With continued interest in medical practices over the last decade, the advent re-opening and vaccinations led to a strong recovery of M&A activity for medical practices, recognizing only a small shortfall for 2020 from 2019 deal volume.

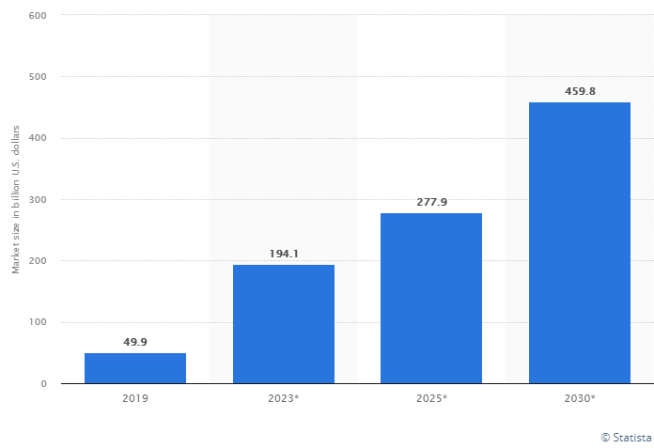

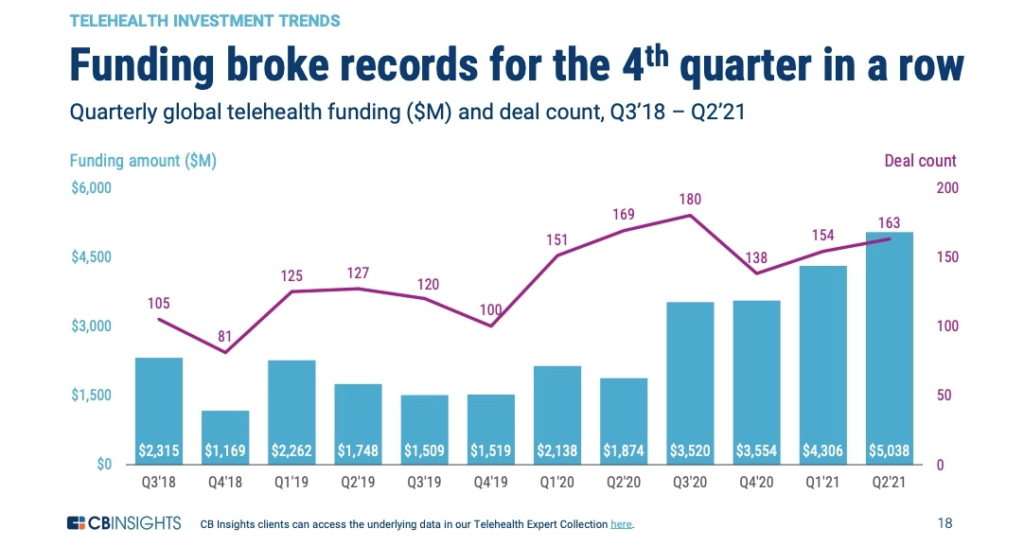

The addition of technology, specifically telemedicine, has advanced interest in the industry. Telemedicine grew in public acceptance during the COVID-19 pandemic and is forecasted to continue growth, as shown in the graph below. Telemedicine increases efficiency in general medical practice operations and from a customer standpoint makes the process of seeking care more seamless. Younger and healthier generations are more comfortable receiving advice and recommendations through online platforms. Doctors and Physicians note this to be one of the most distinct increases in profitability to their practices. They attribute the cost-cut to a lessening need for frontline workers as technology bridges their services with the customer, cutting out the need for excessive administrative assistance.

Projected Global Telemedicine Market Between 2019 and 2030

Private Equity Attraction

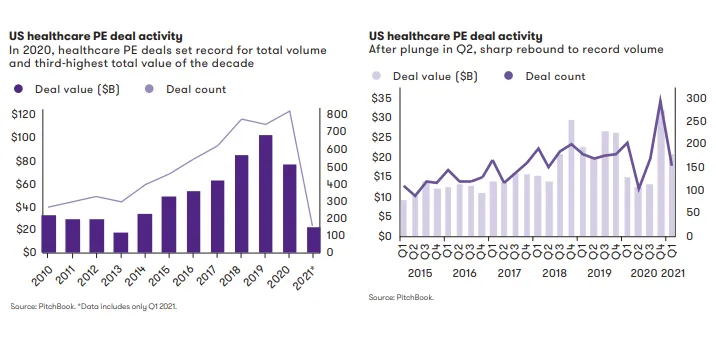

The revenue cycle and financial predictability of physician practices are attractive to investors. Expense reimbursements from insurance, government, and other financial protection programs typically have wider coverage of overhead costs than other lines of business, which simplify expense costs. Higher valuation multiples create a need for more capital on the front-end but generate higher returns and typically favor high revenue growth in the long-term. Acquisitions between 2019 and 2020 averaged pricing around 70% of overall annual revenue, beating the industry standard of 40-50%.

Following the pandemic, the peak in deal value has increased, showcasing the willingness of investors to see these deals as lucrative in the long-term. Specifically, in 2019, 2020 and Q1 2021, the peak and relatively high volume reinforce forecasts for the trend to continue upward as we close the year and begin a similar movement into 2022.

What Investors Need to Know

Due to majority practices operating relatively on a small scale, financial audits are not common, and cash basis accounting is typical. This information can be crucial when evaluating a business and their cash flows but is even more important during due diligence because of uncertainty in cash basis accounting to create accurate forecasts and cash flow projections. The conversion to an accrual basis will help solidify revenue streams, though it does require more work to compile.

Pro forma adjustments will likely need to be made to accurately account for owner and provider compensation during due diligence, as there tend to be high payouts to those parties involved within practices.

What Practice Owners Need to Know

Succession planning is one of the most important decisions medical practice owners face, and it is one that many do not consider until it is too late. Without creating a plan, it can be time consuming to find a replacement that lives up to personal standards or simply a replacement in the operating demographic at all. Doctors should consider their exit timing 3-6 years before they expect to retire or sell. Besides succession planning, there are several other key value drivers including increasing communication and management capabilities, marketing and branding, social media, and allocating time and energy to developing a feasible mission for the practice based on common goals.

Value through mergers and acquisitions (M&A) can be an opportunity most practice owners do not think about, as the task seems overbearing or too abstract to consider. Though it does require a certain allocation of time and energy, the benefits create opportunities for focus on core competencies and overall growth of the practice. The major creators of value come through culture, brand recognition, and overall business structure. Different strategies and business models can work together when based on common practices and aimed for a targeted goal, whether that be through integration of additional services or geographical positioning.

The “in-house”, rather than traditional outsourcing, approach creates an opportunity for growth without major sourcing of capital. Research points to pathology lab services as being a way to source ancillary revenue, but there are dominant players in this field which create competition and friction when looking to expand in these areas. Companies like Myriad Genetics, DaVita, Genomic Health and Bio-Reference Laboratories are making this process more and more difficult, due to the low cost of simply outsourcing to a larger business that can provide services at a fraction of the cost; however, decreasing expenses by using internal employees to complete work that has been traditionally outsourced can help to boost the bottom-line.

Though cash basis accounting may make the most sense to medical practice management, investors are looking to use accrual-based bookkeeping to generate their projected returns. If a practice is positioning to sell or in the market to do so, it may be in the best interest of the management team to begin the transition to accrual accounting to help expedite the due diligence process for most investors.

Summary or Representative Transactions

Dermatology

In Q3 2020, Sheridan Capital Partners (“Sheridan”) completed partnerships with The Skin Care Center, Buckeye Dermatology, Dermatology Partners, DermacenterMD and South Charleston Dermatology. Sheridan’s portfolio company, Dermatologists of Central States (“DOCS”), now holds the company equities, solidifying their market presence in Ohio and West Virginia. The investment was strategic, as they looked for culture, a patient-first mentality, and a specific focus on the clinical experience, according to Sheridan CEO, John Macke. Additionally, the firm has onboarded 32 new providers in the prior year, solidifying their 70 locations. This allows for less management responsibility and more focus on patient care.

Dental

In Q4 2020, Sun Capital Partners signed an agreement with Aspen Dental Management (ADMI) to sell ClearChoice Management Services, which provides high-quality administrative practice management services to ClearChoice Dental Implant Centers. Sun Capital used their leveraged buyout specialty to reinforce the deal and accelerate growth, bringing their annual revenue to more than $50 billion among their 375 investments.

In Q3 2021, the Jordan Company announced that an affiliate of The Resolute Fund V (“Resolute V”) has signed a definitive agreement to acquire Dental365 from the founding shareholders and current investor Regal Healthcare Capital Partners. The acquisition is in partnership with Dental365’s founder and CEO, Dr. Scott Asnis, who will continue to lead throughout the process. This marks a near doubling in size each year and over 400,000 patient visits annually. The Company employs over 165 dentists and 800 staff members.

Also in Q3 2021, Endo1 Partners, a rapid-growth Endodontic Partnership Organization (EPO), formed partnerships with 34 practices and 42 specialists in 7 states across the US. The goal was to increase the Company’s national presence, from a market share perspective, as well as in terms of general geography. This marks their entrance into Connecticut, Georgia, Illinois, New Hampshire, North Carolina, North Dakota, and Wisconsin.

Gynecology

In November 2020, Shore Capital Partners (“Shore”) announced partnership with Women’s Health Group (“WSG”), a leading obstetrics and gynecology services provider. The partnership includes WHG’s six existing partners who have established a reputation for high quality medical and surgical care since their founding in 1994. WHG has also maintained impressive growth through new locations, adding service lines and capabilities, and recruiting high-quality talent for the practice. Shore and WHG plan to invest in their people, processes, and infrastructure to support operations, finance, accounting compliance, marketing, human resources, IT, and other areas so focus can be directed at the core competencies: servicing client needs.

Gastroenterology

In December 2020, GI Alliance, the nation’s largest independent gastroenterology services organization, announced their partnership with Gastrointestinal Associates (“GI Associates”), focusing on the Jackson, Mississippi market. GI Associates is nationally recognized for their clinical excellence, bringing brand recognition and overall appeal to both parties. GI Alliance is led and owned primarily by the physicians, operating in Arizona, Arkansas, Illinois, Indiana, Louisiana, Mississippi, Oklahoma, and Texas. This partnership moves the companies closer toward their goal of uniting gastroenterologists across the nation to improve care while servicing the expanding market.

Ophthalmology

In Q1 2021, Eye Health America (EHA) purchased First Vision Group (FVP), Vision Care (VC) and Marlboro Eye Care Associates (MECA), all located in South Carolina. The acquisitions came as part of EHA’s movement to invest in technology and services that value growth and optimal service, now including 60 providers across optical, medical, and surgical fields. Since formation in March 2018, EHA has grown and maintained their title as a leader in the eye care practice management space in the Southeastern US. Their portfolio now consists of 26 locations, 5 ambulatory surgical centers and greater than 800 employees.

Orthopedic

In Q3 2021, Orthopedic Care Partners, The Steadman Clinic, Motion Orthopaedics, and other practices announced affiliation with Tucson Orthopaedic Institute. Tuscon Orthopaedic’s team consists of 33 board-certified physicians who have been recognized for their award-winning care and service, setting the company apart from its competitors.

Telehealth

In Q3 2021, as deals surge and beat previous year performance, additional activity is centered around telehealth. Cigna recently announced its acquisition of MDLive, Bright Health announced their acquisition of Zipnosis, and Walmart announced that it was planning to purchase MeMD. Amazon has also been offering telehealth services to some employees, with plans of expanding to their employee base nationwide. They recently signed their first deal to extend the Amazon Care telehealth app to another company in the upcoming spring.

Conclusion

Multiples paid for practices have continued to increase and can range from 6x EBITDA to 12x plus EBITDA depending on the type of specialty and size and location of the practice. In the short and medium-term, we expect these multiples to be maintained. The robust market creates a very positive opportunity for those looking to succession-plan, partner, or simply exit the business.

How Hancock Advisors Can Help

With high interest in the medical practice industry, practice owners should consider exit strategies and long-term growth or potential investment opportunities which may be on the horizon. The market is producing some of the highest returns ever seen, and Hancock Advisors can help reach those high valuation multiples. Hancock Advisors partners with you to help achieve your business objectives, whether that be valuing and selling your business or searching for a potential opportunity to acquire. We work directly with business owners and investors, specializing in M&A and general corporate finance advice. Our team has a combined 100 years of transaction and industry experience which we use to help businesses evaluate, navigate, and successfully execute a full range of strategic alternatives. We work in partnership with Hancock Askew, a Georgia and Florida based regional accounting firm to support us with expert advice.

References

Click here to download the PDF version of this report.