Introduction

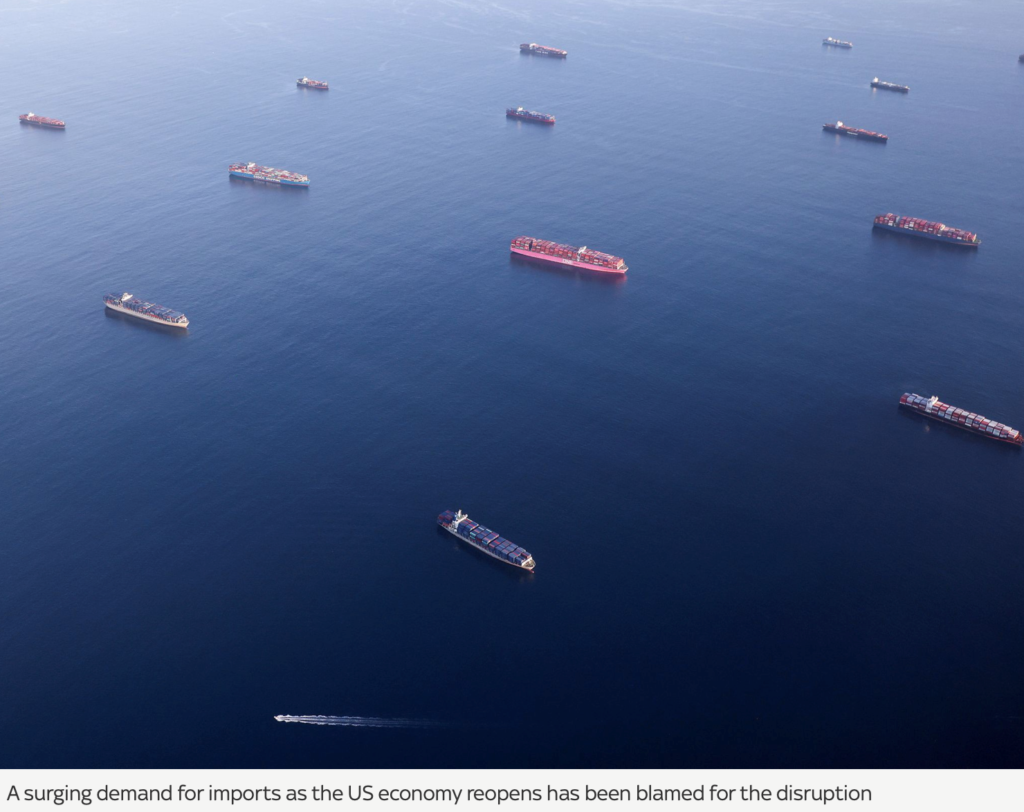

Christmas is canceled in 2021. Ships are stuck in port. FedEx and UPS are overwhelmed. Online ordering has exploded. LTL trucking companies cannot find drivers. A global semiconductor shortage is impacting manufacturers.

In summary, CHAOS has prevailed in the global supply chain spurred by a pandemic that has caused a vast increase in eCommerce demand and disruptions to all aspects of the supply chain.

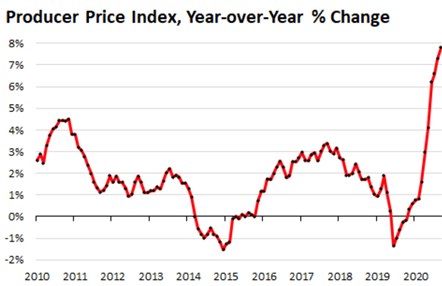

Any economist will tell you that when demand goes up, and supply goes down, prices will increase.

These global pressures indicate that trends will continue for the next one to three years. This analysis presents some opinions on how this global supply chain backlog may play out in the coming months and how technology can improve the global supply chain.

Transportation

Everyone wants to talk about autonomous transportation, which will become a reality in the future but will take some time to fully deploy and is not a realistic solution to unlock issues in the supply chain gridlock that we are facing today.

Technology will be the solution to improvements in global logistics, but in the short term – it will not be autonomous vehicles but rather:

- Predictive demand planning software

- Inter-enterprise data integration

- Artificial intelligence tools

- Logistics simulation tools

- Alternative routing tools

- Supply chain analytics tools

- Warehouse & manufacturing automation

- Integrated warehouse management tools

Back to the reasons that the global supply chain is strained….

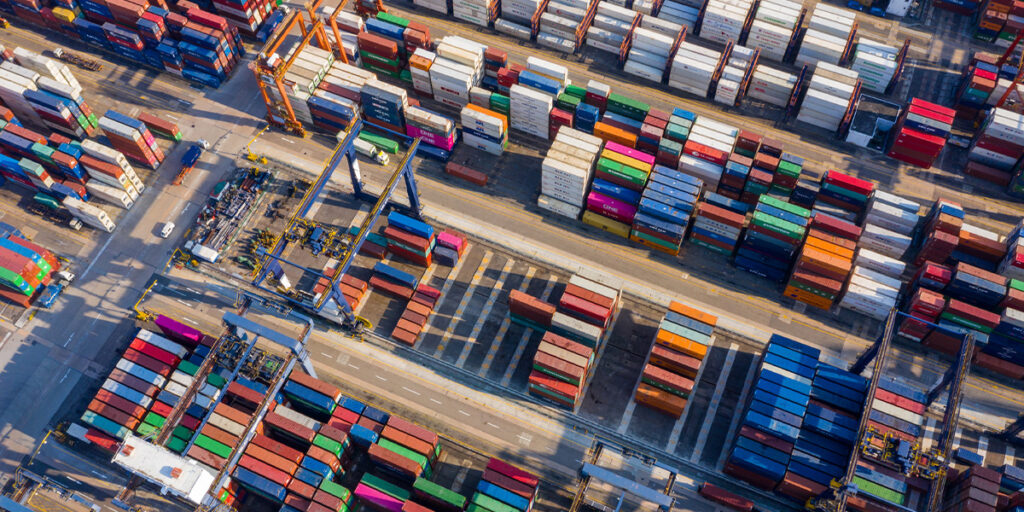

International Shipping

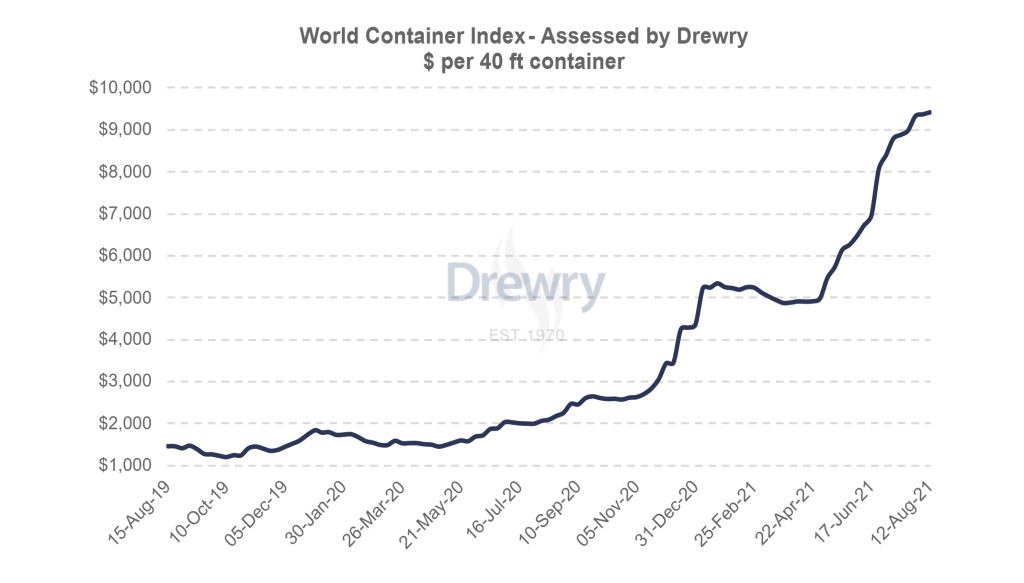

The cost of moving a container from Asia to the U.S. has gone up tenfold in the last ten years. Consolidation of this industry has resulted in a small number of operators who have systematically raised pricing.

Approximately nine cargo carriers control around 80 percent of the global market for ocean vessels. This lack of competition has caused increasing pricing pressure.

An example of how these supply/demand pressures have benefitted the international carriers is Maersk reporting a record $2.7 billion profit for Q1 2021, vs $185 million in Q1 2020.

Railways

There are just seven major railroads in the United States, down from 33 railroads back in the 1970s. Railway pricing is increasing, evidenced by BNSF’s recent price increases this Summer.

This lack of capacity and consolidation of railways has been another factor driving these cost increases.

Businesses reeling from the price increases are willing to pay increasing costs to meet demand from their customers.

LTL Trucking

Driver shortages combined with increased demand have caused pricing pressure in the U.S. trucking industry.

Wage expansion, better benefits and working conditions have attracted new talent to this space which has somewhat eased the crises, but continues to increase cost.

LTL companies are focused on building partnerships and shipper loyalty, while providing flexibility and added benefits to retain drivers.

Technology in terms of route planning and scheduling has also made a positive impact on productivity and efficiency.

Outlook and Summary

Based on all of these macro challenges, our prediction is that supply chains will continue to be stressed in the foreseeable future.

The ultimate solution to the issue will be for operators to invest in supply chain technology to increase efficiency, predict demand, identify critical path items that can be managed and deploy next-generation technology such as artificial intelligence that can supply real-time information.

The leading supply chain management software vendors include Blue Yonder Group Inc., BluJay Solutions Inc., Oracle, Epicor, Infor, Manhattan Associates, Highjump, SAP, Descartes Systems, and WiseTech Global.

Investment in warehouse automation will also streamline and assist in the predictability of demand metrics.

According to a recent McKinsey study, financial investors have invested circa $28 billion in supply chain technology businesses since 2015. The largest investment thesis has been in the last mile space followed by road freight platforms that improve pricing and automate communication between shippers and carriers. Technology can optimize the routing to avoid dead runs for LTL drivers.

Delays will continue for the foreseeable future as spiked demand combined with the gridlock caused by the large international freight and rail carriers who control key pinch points in the global supply chain.

In the foreseeable future, increased demand combined with this increased pricing pressure will be passed on to the consumer and will be a crucial component driving inflationary pressure in the U.S. economy.

How Hancock Advisors Can Help

With high interest in the transportation industry, practice owners should consider exit strategies and long-term growth or potential investment opportunities which may be on the horizon. The market is producing some of the highest returns ever seen, and Hancock Advisors can help reach those high valuation multiples. Hancock Advisors partners with you to help achieve your business objectives, whether that be valuing and selling your business or searching for a potential opportunity to acquire. We work directly with business owners and investors, specializing in M&A and general corporate finance advice. Our team has a combined 100 years of transaction and industry experience which we use to help businesses evaluate, navigate, and successfully execute a full range of strategic alternatives. We work in partnership with Hancock Askew, a Georgia and Florida based regional accounting firm to support us with expert advice.

Click here to download the PDF.