1. COLD CHAIN OVERVIEW

Just as the term suggests, the cold chain literally refers to the supply chain logistics of managing perishable products (food & beverage or healthcare) at the appropriate temperature in order to maintain quality and safety from the point of origin through the distribution and retail supply chain to the final consumer. The concept and technology for controlling the temperature of sensitive products have been well established for decades. The development of cold chain solutions, especially in terms of government policy, however, is a fairly new concept. The business functions of cold chain encompass activities and processes that span several industries and support the exports and sales of numerous other industries and geographies, which pose great challenges to standardization and seamless transactions. Nevertheless, the United States has a competitive advantage in cold chain solutions derived from some of the most advanced technologies and logistics management services in the world.

With regard to food safety, the cold chain ensures that perishable products are safe and have high quality at the point of consumption, which leads to the overall protection of public health. Therefore, cold chain solutions are crucial to the growth of global trade in perishable products and to the worldwide availability of food and health supplies. Nevertheless, billions of tons of fresh food products and millions of dollars’ worth of U.S. exports are lost each year due to poor cold chain solutions in developing markets. To put it simply, nearly half of all food never makes it to a consumer’s plate and global losses in the food industry total more than $800 billion annually.

In terms of healthcare product distribution, cold chain plays a vital role in guaranteeing the efficacy of bio-pharma products, such as samples and vaccines (which often require a specific range of temperature), during the course of transportation and storage. The maintenance of temperature is especially relevant during a pandemic, where COVID-19 has cost millions of lives and a vaccine is in sight to be distributed to billions of people. The most recent information indicates that the first COVID-19 vaccine candidate announced to be effective, from Pfizer-BioNTech, requires two doses and cold storage at –94°F, or -70°C. Vaccine distribution mandates a seamless un-broken cold chain from the manufacturer to the point-of-use, nevertheless, the drastically cold temperature this vaccine requires poses great challenges to developed economies like the United States.

Due to the role it plays in food safety and health product distribution, it is not hard to tell that cold chain providers contribute a great deal to the economy and workforce. With recent catalysts such as produce, prepared food delivery and vaccine distribution, our house view is that this is a once-in-a-lifetime opportunity to invest in this industry, as we will discuss later.

2. COLD CHAIN LANDSCAPE

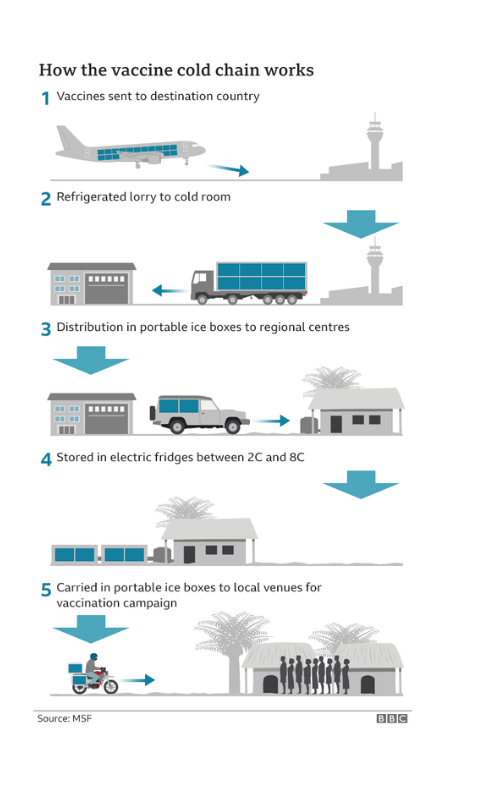

The series of warehousing and distribution activities that comprise a cold chain network are designed to ensure ideal storage and transportation conditions for temperature-sensitive products. Each link in the cold chain must maintain the same level of integrity for the customer to receive a satisfactory product, as an end-to-end cold chain is only as efficient and secure as the weakest link in the system.

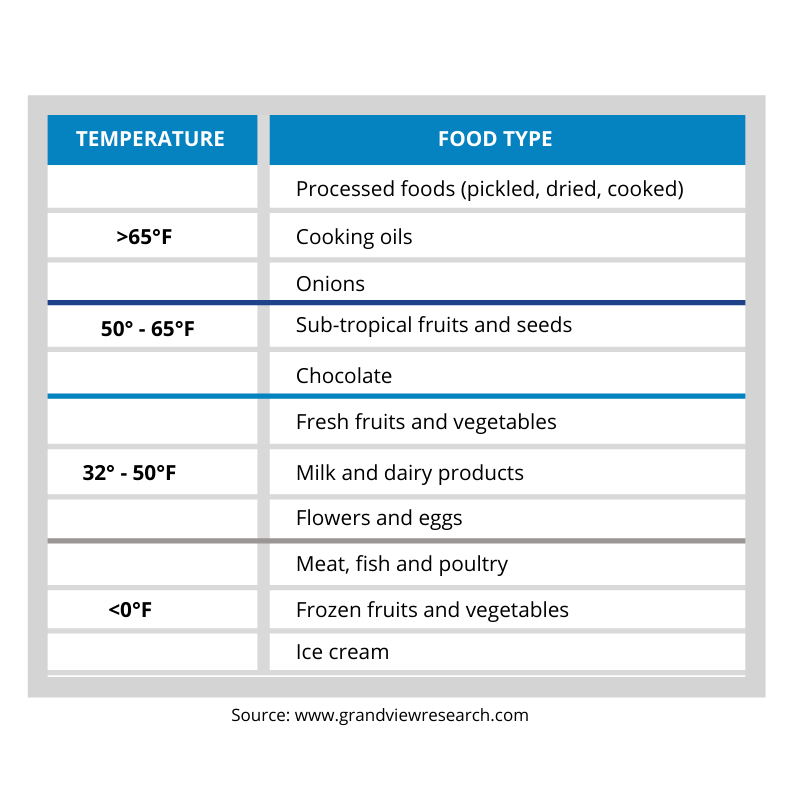

The exact structure of each cold chain varies significantly depending on product and customer requirements; however, the goal of a properly designed cold chain system is to safely move temperature- sensitive products in a way that reduces waste, maintains the quality and integrity of the product and limits opportunities for bacterial contamination. A complete cold chain system may include post-harvest pre-cooling or freezing, processing, temperature-controlled warehouse or storage, retail or distribution and refrigerated transport between locations.

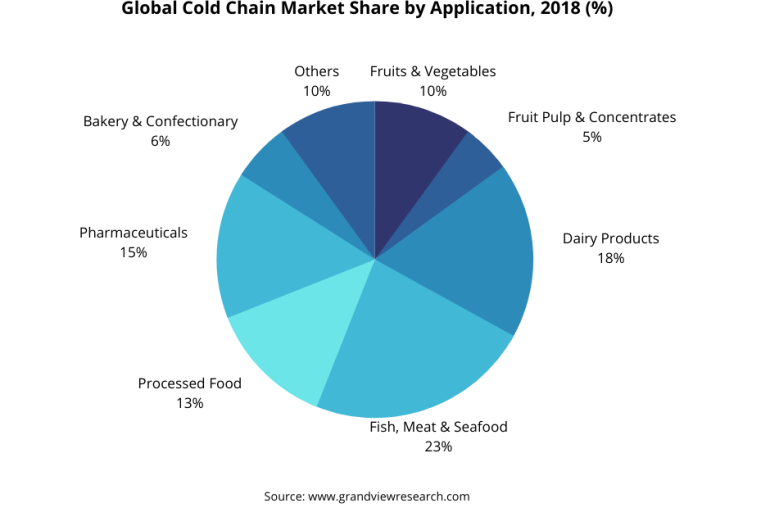

While food and beverage products are the most commonly associated commodities that utilize cold chains, they are not the only ones. Many pharmaceuticals, vaccines, bioengineered drugs and biologics that are derived from living cells must remain within a limited range of temperatures to maintain their viability. To meet these requirements, U.S. express delivery service providers, such as FedEx and UPS, along with foreign companies such as DHL, have made huge investments to develop complete logistics.

Due to cold chain service’s multiple industrial components, we will break down the global value chain as business functions to reflect the various activities and businesses involved in the service. The following is a snapshot of the cold chain service’s warehousing, third party logistics operators, express delivery and industrial transportation equipment functions.

A) Warehousing

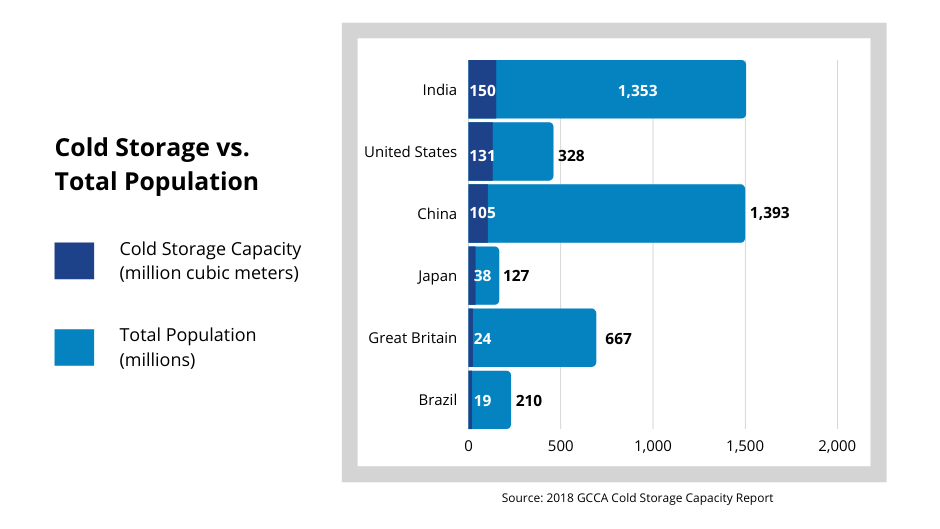

From North America to Vietnam, the cold storage warehouse industry is booming. With primary clients in the pharmaceutical industry and food industry, refrigerated warehouses are essential for pharmaceutical and food safety. In 2019, the average occupancy across the U.S. cold storage warehouse industry was 85%, considered full occupancy and available spaces were trading at a premium.

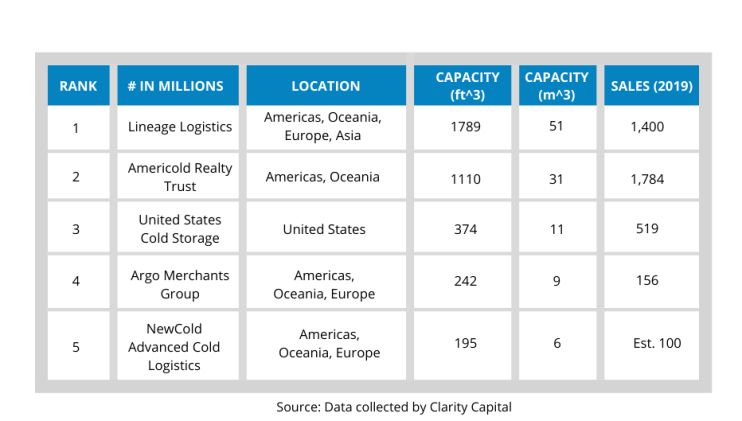

Americold Realty Trust, based in Atlanta, GA, is one of the largest firms by capacity in the cold storage sector in the United States. The company owns 183 temperature-controlled warehouses in the United States, Canada, Australia, New Zealand, and Argentina, operates 1.1 billion cubic feet of refrigerated storage and had nearly $3.1 billion in annual sales in 2019. Americold serves more than 3,000 customers, mainly producers, retailers and food service providers, including Tyson, Heinz, Con-Agra and General Mills, with more than 90,000 freight shipments each year. United States Cold Storage, Inc. is the second largest firm domestically by capacity with 374 million cubic feet of refrigerated storage and $520 million in sales in 2019. Americold recently acquired the fourth largest one, Argo Merchants Group, and we will talk about this deal in the Recent Deals section.

B) Third-Party Logistics Operators

Transportation intermediaries or third-party logistics operators (3PLs) act as the facilitators to arrange the efficient and economical movement of goods. They serve tens of thousands of shippers and carriers on an outsourced basis, bringing together the transportation needs of the cargo interests with the corresponding capacity and special equipment offered by rail, motor, air and ocean carriers. The availability of 3PL services allows businesses to focus on their core competencies while having 3PL’s specialized systems handle most or all of their logistics requirements.

The 3PL market is growing, and according to PRNewswire, the 3PL market has expanded significantly throughout 2019, contributing to a total valuation of approximately $1.5 trillion by 2025. In addition to that, the role of 3PLs to manage fulfillment in the cold chain is likely to grow faster for the foreseeable future due to the increasing role of omni-channel retailing, especially in the fast-growing ASEAN region.

Founded in 1905 and headquartered in Eden Prairie, Minnesota, C.H. Robinson Worldwide, Inc. is the largest 3PL in the United States with $15.5 billion in sales in 2019. With few physical assets of its own, the company contracts with more than 78,000 carriers around the world to manage 18 million shipments to more than 119,000 customers. In addition, the company is involved in buying, selling and marketing fresh produce, including fresh fruits, vegetables and other perishable items under the Robinson Fresh name. Earlier this year, the company finalized the acquisition of Prime Distribution Services (“Prime”), a leading provider of retail consolidation and value-added warehouse services in North America, from Roadrunner Transportation for $225 million. C.H. Robinson financed the acquisition and related fees and expenses with cash on hand and funds drawn from its existing credit facilities. According to C.H. Robinson’s news release, the acquisition will expand the company’s retail consolidation business and brings additional scale, capabilities and expertise to its portfolio.

C) Express Delivery Services

United Parcel Service, Inc. (UPS) is one of the largest logistics and delivery conglomerates that provides letter and package delivery, specialized transportation, logistics and financial services. One of its subsidiaries, UPS Supply Chain Solutions, is among the top 3PL service providers, though UPS’ primary focus is as an express delivery service provider that transports more than 22 million packages per day to over 220 countries. According to the UPS 2019 fact sheet, the company operates more than 125,000 vehicles, over 600 aircraft and exceeded $80 billion in sales in 2019. UPS also offers Temperature True, a one-stop cold chain solutions program, to various healthcare-related businesses, such as specialty pharmaceuticals and research labs. It is composed of a global network of healthcare-optimized facilities that includes 8 million square feet across more than 100 warehouses with temperature- and humidity- controlled environments to ensure products remain in optimal conditions during transit and storage. As we mentioned earlier, healthcare cold chain is especially relevant during the pandemic and vaccine storage and distribution will pose heightened demand for similar services provided by Temperature True.

Not too far behind, FedEx is another major delivery service provider in the United States, which delivers more than 16.5 million packages per day to more than 220 countries. With more than 180,000 vehicles and over 650 aircraft, FedEx projected nearly $70 billion in sales for 2020. Similar to UPS, FedEx has also developed logistics hubs throughout the world, catering to temperature-sensitive transportation by using a system called SenseAware that can monitor product vitals of humidity, location and light exposure at temperatures as low as -238°F. With the cold chain solutions they have developed, we believe both companies will play a significant role in the upcoming events of COVID-19 vaccine storage and distribution.

D) Industrial Transportation Equipment

The main transportation equipment used in the cold chain is reefers or refrigerated trailers. Utility Trailer Manufacturing Company is the largest manufacturer of such equipment in the United States and generated annual sales of $845 million in 2019. Founded in 1914 and headquartered in City of Industry, California, the company offers equipment such as dry freight vans, refrigerated vans and flatbeds and stresses excellence of quality in its manufacturing process. Other manufacturers of refrigerated trailers and commercial trucks and vans include Wabash National with a variety of manufactured products, J.B. Poindexter, which focuses on specialized trucks and vans and Great Dane Trailers with a variety of dry bed, flatbed and refrigerated sales. Deal activities have been slow in this space. The most recent deal Utility Trailer Manufacturing Company did was in 2011, and it has seen declining sales in recent years.

3. COLD CHAIN RECENT DEALS

A) Americold Realty Trust

As we mentioned earlier, Americold Realty Trust recently announced that it has entered into an agreement to acquire the world’s fourth-largest temperature-controlled operator, Agro Merchants Group, for $1.74 billion. The $1.74 billion deal will consist of $554.3 million in Americold stock, $519 million in cash, the repayment of $560 million of Agro debt and the assumption of $110 million of Agro’s capital leases and sale leaseback agreements. Founded in 2013, Agro has a portfolio of 46 refrigerated warehouses that include 242 million cubic feet across 10 countries in Europe, North America, South America and Australia. According to Americold President and CEO Fred Boehler, the acquisition of Agro represents a unique opportunity to acquire an institutional-quality global portfolio that facilitates its strategic entry into Europe and adds complementary locations in the U.S., South America and Australia, where Americold is already established. After the close expected in early 2021, Americold’s portfolio will consist of 229 owned and managed facilities and 1.35 billion refrigerated cubic feet.

Americold has been very active in M&A in recent years. Besides the above-announced deal in October, it also acquired privately held Cloverleaf Cold Storage from its management and a private equity investor group for $1.24 billion in June 2019. Based in Sioux City, Iowa, Cloverleaf added 22 facilities with 132 million refrigerated cubic feet in the central and southeast U.S. to Americold’s holdings. The deal also broadens Americold’s position in what it termed the “protein business” segment, meaning the supply chains for fish, poultry, beef and the like. Chicken, in particular, has soared in popularity in recent years as western societies concerned about cost and health issues consume lower amounts of beef products in favor of less-expensive poultry.

In addition to the two major deals, Americold also closed a deal to acquire Canadian-based cold storage facility operator Nova Cold Logistics for C$337 million (a Canadian dollar equals US$0.75.) from asset management firm Brookfield Business Partners. The acquisition of Nova Cold provides Americold three new locations, Toronto, Calgary and Halifax, with 23.5 million cubic feet and 81,000 pallet positions of capacity. Further, the Atlanta-based real estate investment trust purchased a newly constructed cold storage facility in Tampa, Florida, for $25 million and closed on the previously announced acquisition of AM-C Warehouses in Texas for $82.5 million in August this year. Both deals were funded with cash.

B) UPS and FedEx

In late 2016, UPS purchased Marken, a global provider of supply chain solutions to the life sciences industry, to complement UPS healthcare logistics solutions. Marken serves pharmaceutical companies, clinical research organizations and contract manufacturers to collect and transport clinical trial material and investigational medicinal products to 49,000 clinical trial sites, as well as the shipment of biological samples from these sites to central laboratories. The company has more than 650 employees with an asset-light operating structure and 44 locations worldwide. The acquisition of Marken has helped UPS gain market share over FedEx and DHL, which at the time dominated the healthcare logistics market.

Earlier in 2016, FedEx acquired Dutch courier delivery company TNT Express, a market leader in healthcare cold chain logistics, for €4.4billion (a Euro equals US$1.19.) Currently, the company has more than 90 cold chain facilities in its network to keep goods cold while not in transit.

4. OPPORTUNITY IN COVID-19 VACCINE DISTRIBUTION

On November 9 and November 16, 2020, Pfizer-BioNTech and Moderna respectively announced two leading COVID-19 vaccine candidates that are over 90% effective. But these vaccines, which use strands of genetic material known as mRNA, also have some stringent temperature requirements. According to their news releases, Moderna’s vaccine requires long-term storage at -20°C (-4°F) and is stable for 30 days between 2° and 8°C (36° to 46°F). Pfizer and BioNTech’s vaccine, however, requires some of the coldest temperatures of any vaccine under consideration: -70°C (-94°F) or lower. Both vaccines will likely require two doses, and fast.

No doubt that the success of COVID-19 immunization will depend on delivering temperature-controlled vaccines to every community, village and settlement in the world, but the temperature and scale requirements of the distribution campaign even pose great challenges to developed economies like the United States. As we discussed earlier, the healthcare cold chain is very specific and the integrity of the whole system depends on the weakest link. According to the Wall Street Journal, currently Pfizer’s vaccine shipping system can hold up to 5,000 doses of its vaccine at -70°C for those 10 days. The company is also spending more than $2 billion to create its own distribution network, aiming to ship these containers on a just-in-time basis to the places that need them, bypassing the need for warehouses.

However, investment at the company level is not enough. The volume and speed that a global COVID-19 vaccination will need requires an entirely new fast-track investment from the government, like Operation Warp Speed, the $10 billion US government vaccine development effort, which aims to have 300 million doses of a COVID-19 vaccine produced by January 2021. Therefore, we believe that the vast demand for cold chain logistics will require coordinated efforts to strengthen the weaker links in the supply chain and invite huge amounts of investments from the public and private sectors, thus creating enormous opportunities for investors to benefit from capital appreciation of cold chain participants in the coming months.

5. CONCLUSION

Based on the above information, we believe that the global immunization effort could offer an once-in-a- lifetime opportunity to create sustainable and resilient cold chain distribution solutions. The two vaccine candidates already put the spotlight on vaccine distribution networks and the challenges posed by the current system. There’s no doubt that local governments, global conglomerates and private logistics companies will make concerted efforts to consolidate the global cold supply chain. Therefore, we believe that this is the right time to invest in cold chain companies, especially private companies that provide specific healthcare cold chain solutions, which will greatly benefit from the investments and efforts next year.

Click here to download the Cold Chain Primer.